TSMC Q1 profits increase by 9% and profit expectations on strong AI chip demand.

TSMC (Taiwan Semiconductor Manufacturing Company) surpassed its first-quarter revenue and profit forecasts on Thursday, largely thanks to the sustained high demand for advanced circuits, particularly those utilized in artificial intelligence applications. Compared to LSEG consensus estimates, Taiwan Semiconductor Manufacturing Company’s first-quarter results are as follows:

Table of Contents

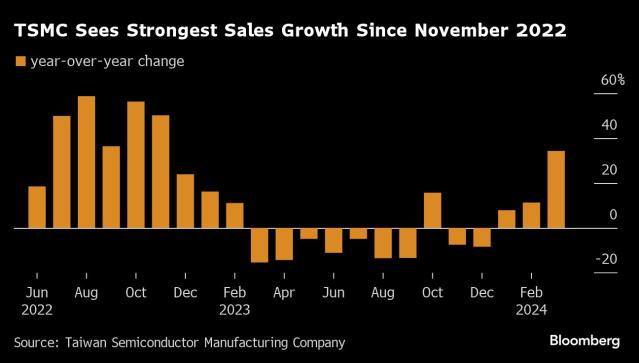

Taiwan Semiconductor Manufacturing Company reports an 8.9% increase in net income to NT$225.49 billion from the previous year, and a 16.5% rise in net sales to NT$592.64 billion. The company had forecasted sales for the first quarter to be between $18 billion and $18.8 billion. As the world’s largest high-tech CPU manufacturer, TSMC serves top clients such as Apple and Nvidia.

- Net revenue: NT$592.64 billion ($18.87 billion), exceeding the expected NT$582.94 billion.

- Net income: NT$225.49 billion, surpassing the anticipated NT$213.59 billion.

“Taiwan Semiconductor Manufacturing Company maintains a strong performance stance, underpinned by significant industry trends. The continuous demand for advanced processors, particularly for AI applications, bodes well for both the short and long term. Brady Wang, a senior analyst at Counterpoint Research, mentioned before Monday’s data release that TSMC’s focus on advanced chip development, like the shift towards 3nm technology, is another driver of the company’s long-term growth.”

Currently, TSMC is producing 3-nanometer chips and plans to commence mass production of 2-nanometer chips in 2025. Smaller nanoscale processors are generally more powerful and efficient. Over the past year, Taiwan Semiconductor Manufacturing Company’s stock has surged by 56% due to robust demand for AI chips, spurred by the rise of large language models like ChatGPT and their Chinese counterparts.

According to recent statistics from Counterpoint Research, Taiwan Semiconductor Manufacturing Company accounted for 61% of the global semiconductor revenue in the latest quarter, with Samsung Foundry securing second place at 14% market share.

“Taiwan Semiconductor Manufacturing Company’s robust competitive edge is reflected in its net profit margin, which, at 40%, remains one of the highest in the company’s history, compared to the industry average of 14%,” said Grzegorz Drozdz, a market analyst at Conotoxia, last week. He attributed the high margin to an increased sales share of 7nm and smaller chips, which command much higher margins.

Furthermore, the United States has recently greenlit a preliminary application from Taiwan Semiconductor Manufacturing Company’s Arizona subsidiary for up to $6.6 billion in government funding to develop the world’s most advanced semiconductors. Taiwan Semiconductor Manufacturing Company is also eligible for nearly $5 billion in proposed loans.

Earlier this month, Taiwan experienced its most severe earthquake in 25 years. Some fab workers were evacuated as a precaution, but a Taiwan Semiconductor Manufacturing Company spokesperson reported that initial inspections showed the company’s facilities were unscathed, and the employees have since returned to work.

TSMC’s Q1 profits rise by 9%.

The market was caught off guard by the 9% rise in first-quarter net profit announced by Taiwanese chipmaker Taiwan Semiconductor Manufacturing Company (2330.TW), as it capitalized on the surging demand for transistors used in AI applications.

Taiwan Semiconductor Manufacturing Co Ltd (Taiwan Semiconductor Manufacturing Company), the world’s largest contract chipmaker, and supplier to Nvidia (NVDA.O), saw its net profit soar to T$225.5 billion ($6.97 billion) from T$206.9 billion in the previous year, from January to March. This figure surpassed the LSEG SmartEstimate of T$218.1 billion, which tends to be weighted towards more accurate expert forecasts. The exchange rate is $1 to T$32.3350.

People also Reading:

Will the Price of Bitcoin Increase Again?

What kind of expectations does Samsung Elec have for the luxury chip packaging industry?

What is next move of Bitcoin? Boom Or bust?

US House approves bill mandating that ByteDance remove TikTok or risk being banned.

Authors sue Nvidia over AI use of copyrighted works.

With Big Tech rushing to comply with EU regulations, investigations are anticipated.

OpenAI seeks to dismiss all of Musk’s claims in lawsuit.

Google implements changes for users and app developers as EU tech rules loom.

Bitcoin surges past $64,000, setting new records.