S&P 500 gains 1% to reach an all-time high, breaking the 2022 record: real-time updates.

After a brief market decline to begin the year, investors resumed purchasing stocks in large quantities, and the S&P 500 shut at a record high on Friday.

The closing high from January 2022 and the previous record intraday high were both surpassed by the 1.23% increase in the broad market index, which ended at 4,839.81. The Dow Jones Industrial Average, which had previously set a record for itself at the close of the previous year, gained 395.19 points, or 1.05%, to close at 37,863.80. At 15,310.97, the Nasdaq Composite increased by 1.70%. With a gain of 1.95%, the smaller and more tech-focused Nasdaq-100 also reached a record high.

Table of Contents

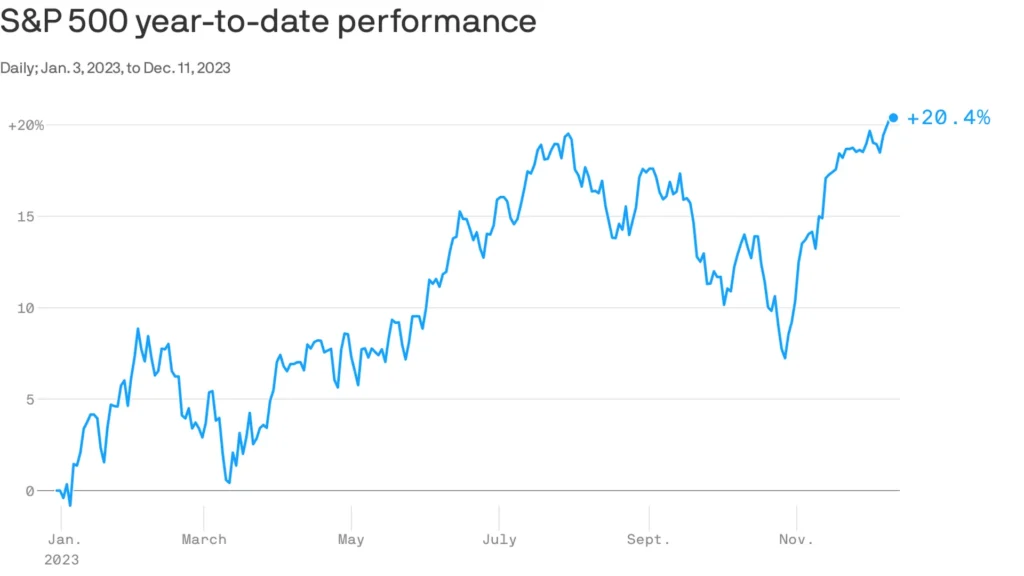

After Friday’s rally, the 30-stock Dow turned green, putting all three major averages within positive territory for 2024. The S&P 500 saw a 24% gain in 2023 after losing 19% in 2022 as the economy avoided the downturn that many had predicted, and inflation dropped to a point where the Federal Reserve could halt rate increases. After a strong fourth-quarter rally, the benchmark almost set a record, but ultimately failed to do so. At the beginning of 2024, the market upswing paused slightly as investors cashed in on market leaders in Big Tech, such as Apple.

However, in recent days, they went back to purchasing those tech leaders. This Friday’s milestone validates that we are in a genuine bull market—which started in October 2022—instead of just a correction within a slumping market. Since then, the S&P 500 has increased by more than 35%.

“Investors believe that companies that are at the forefront of artificial intelligence (AI) or that have a unique product offering are significantly leading the market.” That has been a wave that has continued into 2024 and the rest of last year, according to the Northwestern Mutual Financial Management’s chief portfolio manager Matt Stucky.

The tech sector was the best-performing sector week for the S&P 500 so far, rising 2.35 percent on Friday and over 4 percent over the trading week. In 2024, “it will depend on the Fed’s ability to implement a gradual reduction in rates or not,” Stucky predicted, regarding the wider market index’s ability to sustain its upward trajectory. He pointed out that multiples, not earnings, would be the primary factor driving the S&P 500’s growth in 2023.

“After economic downturns, multiples increase as investors price in a recovery. It’s reasonable to wonder if it’s sustainable to not just maintain current highs but also reach new ones in the future, Stucky continued, if that recovery doesn’t happen.

Consumer confidence regarding inflation and the economy appears to be growing, according to new consumer data released on Friday. In July 2021, the University of Michigan’s Survey of Consumers reached its highest level, exhibiting a 21.4% year-over-year jump.

Travellers Insurance Company saw a 6.7% increase in shares following a beat in earnings. After outperforming both the top and bottom lines, Schlumberger gained 2.2%, while Ally Financial jumped over 10% following the release of impressive quarterly results and the purchase of an enterprises section to Synchrony Financial.

Friday’s closing stock price increase

The trading session on Friday saw U.S. stocks close higher. The S&P 500 saw gains of 1.23% to 4,839.81, surpassing the record close set in January 2022. The Dow Jones Industrial Average closed at 37,863.80, up about 395 points, or 1.05%. At the close of trading, the Nasdaq Composite was up 1.70 percent, or 15,310.97 points.

Although the stock market is rising, Bitcoin is still expected to have a bad week.

The stock market saw a surge in ether and bitcoin at the end of the week, coinciding with the S&P 500 reaching a record high. Bitcoin’s price rose 2% to $41,763.87 on Friday after reverting to its critical support level of $40,000. At $2,491.82, ether was trading 2% higher.

According to Ryan Rasmussen, a strategist at Bitwise Asset Management, “the rally in risk-on assets was driven by positive investor sentiment and slowing inflation.” “Investors generally see cryptocurrency as riskier and similar to tech, so it makes sense for crypto to rally.”

For a week, Bitcoin is still expected to report a 4% loss. Since bitcoin ETFs were approved for trading in the United States on January 10, it has dropped by 10%. Most people anticipated that the ETF approvals would be a sell-the-news story. Ether is expected to drop by 3% by the end of the week.

But the increase in cryptocurrency assets wasn’t sufficient to boost stocks. Microstrategy, Coinbase, and a number of mining stocks (such as Riot Platforms, Iris Energy, and CleanSpark) were all flat. Marathon Digital saw a 1% increase.

Since the S&P 500’s most recent record, these are the most valuable ETFs.

It looks like the S&P 500 will close at its highest level since January 3, 2022. Many funds with a narrow focus have made significant gains in the interim. International funds as well as energy plays make up the best-performing non-leveraged equity exchange-traded funds (ETFs) since the S&P 500’s previous record high, according to FactSet.

During that time, the iShares MSCI Turkey ETF (TUR) has increased by almost 80%. The Global X MSCI Argentina ETF (ARGT) has increased by over 64%, and the Invesco Oil and Gas Services ETF (PXJ) has increased by more than 68%.

Top Related Articles

After three days, net inflows into the Bitcoin ETF approach $1 billion.

Bitcoin approaches to its high for the first time since April 2022.

Toshiba delists amid a crisis after 74 Years

Fed maintains current rates, announcing three reductions in 2024

The offer is still valid. Details https://zetds.seychellesyoga.com/jml

Content for your website https://zetds.seychellesyoga.com/info

Web Development Wizards https://zetds.seychellesyoga.com/info

Can provide a link mass to your website https://zetds.seychellesyoga.com/info

Your site’s position in the search results https://zetds.seychellesyoga.com/info

Free analysis of your website https://zetds.seychellesyoga.com/info

Content for your website https://zetds.seychellesyoga.com/info

Web Development Wizards https://zetds.seychellesyoga.com/info

Can provide a link mass to your website https://zetds.seychellesyoga.com/info

Your site’s position in the search results https://zetds.seychellesyoga.com/info

Free analysis of your website https://zetds.seychellesyoga.com/info

SEO Optimizers Team https://zetds.seychellesyoga.com/info

I offer mutually beneficial cooperation https://zetds.seychellesyoga.com/info

Cool website. There is a suggestion https://zetds.seychellesyoga.com/info

I really liked your site. Do you mind https://zetds.seychellesyoga.com/info

Here’s what I can offer for the near future https://zetds.seychellesyoga.com/info

You will definitely like it https://zetds.seychellesyoga.com/info

Content for your website https://ztd.bardou.online/adm

Web Development Wizards https://ztd.bardou.online/adm

Can provide a link mass to your website https://ztd.bardou.online/adm

Your site’s position in the search results https://ztd.bardou.online/adm

Free analysis of your website https://ztd.bardou.online/adm

SEO Optimizers Team https://ztd.bardou.online/adm

I offer mutually beneficial cooperation https://ztd.bardou.online/adm

Cool website. There is a suggestion https://ztd.bardou.online/adm

I really liked your site. Do you mind https://ztd.bardou.online/adm

Here’s what I can offer for the near future https://ztd.bardou.online/adm

Content for your website https://ztd.bardou.online/adm

Web Development Wizards https://ztd.bardou.online/adm

Can provide a link mass to your website https://ztd.bardou.online/adm

Your site’s position in the search results https://ztd.bardou.online/adm

Free analysis of your website https://ztd.bardou.online/adm

SEO Optimizers Team https://ztd.bardou.online/adm

I offer mutually beneficial cooperation https://ztd.bardou.online/adm

Cool website. There is a suggestion https://ztd.bardou.online/adm

Content for your website http://myngirls.online/

Web Development Wizards http://myngirls.online/

Can provide a link mass to your website http://myngirls.online/

Your site’s position in the search results http://myngirls.online/

Free analysis of your website http://myngirls.online/

SEO Optimizers Team http://myngirls.online/

I offer mutually beneficial cooperation http://myngirls.online/

Content for your website http://fertus.shop/info/

Web Development Wizards http://fertus.shop/info/

Can provide a link mass to your website http://fertus.shop/info/

Your site’s position in the search results http://fertus.shop/info/

Free analysis of your website http://fertus.shop/info/

SEO Optimizers Team http://fertus.shop/info/

I offer mutually beneficial cooperation http://fertus.shop/info/

Cool website. There is a suggestion http://fertus.shop/info/

I really liked your site. Do you mind http://fertus.shop/info/

Here’s what I can offer for the near future http://fertus.shop/info/

You will definitely like it http://fertus.shop/info/

The best prices from the best providers http://fertus.shop/info/

Additional earnings on your website http://fertus.shop/info/

Analytics of your website http://fertus.shop/info/

I would like to post an article http://fertus.shop/info/

How to contact the administrator on this issue http://fertus.shop/info/

Shall we exchange links? My website http://fertus.shop/info/

The offer is still valid. Details http://fertus.shop/info/

We offer cooperation on SEO optimization http://fertus.shop/info/

Content for your website http://fertus.shop/info/

Web Development Wizards http://fertus.shop/info/

Can provide a link mass to your website http://fertus.shop/info/

Content for your website http://fertus.shop/info/

Can provide a link mass to your website http://fertus.shop/info/

Free analysis of your website http://fertus.shop/info/

I offer mutually beneficial cooperation http://fertus.shop/info/