Asia shares soar as the Fed looms large; the yen falls below a critical threshold.

Ahead of this week’s Federal Reserve policy meeting, Asian stocks began the week on a bullish note on Monday, as the dollar crossed above the psychologically significant 160-yen threshold for the inaugural time in decades.

The anticipation that longer-term, higher U.S. mortgage rates would reduce demand for oil led to a little decline in oil prices, while reports of a possible truce in Gaza reduced concerns about supply shortages.

Table of Contents

The dollar had a sharp but short-lived spike during Asia hours, reaching a record high of 160.245 yen, its highest level in 34 years. It recently traded at 159.14 yen, 0.5% higher.

Asian stocks started the week on a positive note on Monday, ahead of this week’s Fed meeting, as the dollar broke above the psychologically critical 160-yen threshold for the first time in decades.

Reports of a potential truce in Gaza allayed fears about supply shortages, while longer-term, higher U.S. interest rates were expected to curb demand for oil, which caused a little dip in oil prices.

Amid the Asia-Pacific hours, the dollar had a brief but intense surge, hitting an unprecedented high of 160.245 yen—the most recent peak in 34 years. It was recently trading 0.5% higher at 159.14 yen.

At the end of the central bank’s monetary policy meeting on Friday, the BOJ maintained interest rates near zero and ruled out moving towards a full-fledged decrease in the BOJ’s asset purchases, adopting a more dovish stance than some had anticipated.

This, together with predictions that the Fed would postpone the beginning of its cycle of rate cuts, gave yen bears further momentum.

With Wall Street’s strong lead on Friday due to a surge in mega cap growth firms, MSCI’s benchmark index of Asia-Pacific equities outside Japan (.MIAPJ0000PUS) opens new tab tacked on 0.56% in the broader market.

The positive attitude persisted into the upcoming week, as evidenced by the 0.2% rise in S&P 500 and Nasdaq futures.

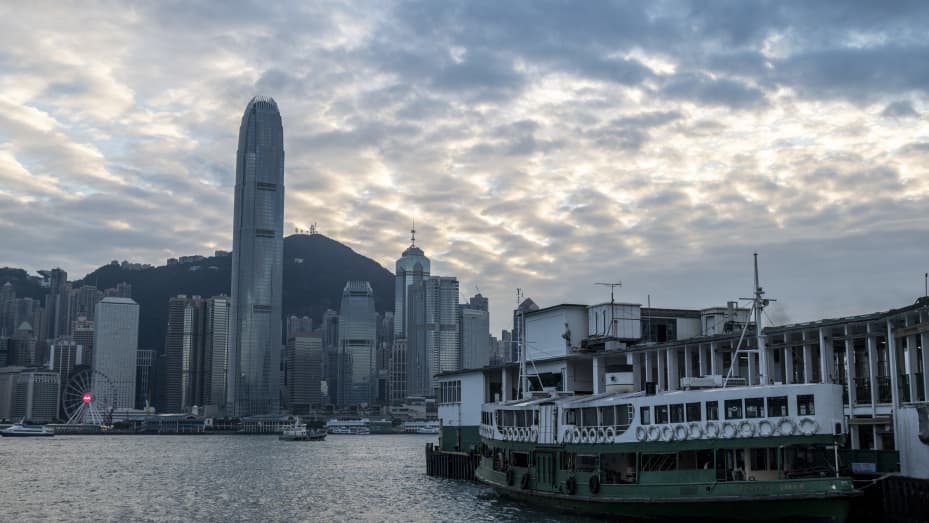

The Hang Seng Index (.HSI) of Hong Kong opened a new tab that climbed 0.77%, while the blue-chip index (.CSI300) of China opened a new tab that crept higher by 0.06%.

The focus of the week will be the Federal Reserve’s two-day monetary policy meeting, which starts on Tuesday. It is anticipated that the central bank will maintain rate stability.

The emphasis will be on the Federal Reserve’s rate outlook guidance, though, after market wagers on when the Fed will start its rate-easing cycle were derailed by several runs of better-than-expected United States economic data and persistent inflationary pressures.

From a June start just a few weeks ago, market pricing indicates that the first Fed rate decrease is projected in September, with roughly 30 basis points of easing anticipated this year.

“There has been a notable adjustment in the expected interest rates in the United States, which serves as a model for interest rates around the world,” stated Kiwibank Chief Economist Jarrod Kerr.

“I think the Fed this week will kind of echo those comments that rate cuts aren’t as close as they had hoped.”

The expectation that U.S. interest rates would stay in restrictive territory longer has helped to support the dollar, even though it was generally weaker on Monday, sliding down versus all but the yen.

The euro increased by 0.21% to $1.0715 against the dollar, while the value of sterling increased by 0.23% to $1.2522.

Despite heading for a 1.4% monthly increase, the dollar index showed little movement at 105.98. Commodity prices dropped by more than 1% for Brent and U.S. oil, respectively, to $88.55 and $83.02 per barrel.

Both have increased by almost 15% year to far, partly as a result of worries about supply disruptions brought on by the Middle East’s growing geopolitical unrest.

A Hamas source said the news channel on Sunday that a delegation from Hamas will travel to Cairo on Monday to hold discussions aimed at achieving a ceasefire. This comes as negotiators increased their efforts to come to an agreement before an anticipated Israeli attack upon Egypt southern region of Rafah.

Top Reading Articles:

Tech stocks suffer, yen teeters near intervention zone.

Will the Price of Bitcoin Increase Again?

HSBC’s $3 billion write-down in China eclipses record annual profit.

Why the Bank of Japan (BOJ) cancels radical policies.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple: BTC is expected to reach $48,000.

NY AG broadens crypto litigation, identifies $3 billion in fraud.

The IMF predicts that AI will worsen inequality and affect nearly 40% of jobs worldwide.

One Comment