Nvidia briefly reaches a valuation of $2 trillion as the AI frenzy deal Wall Street.

Due to the unquenchable demand for its chips, which made the Silicon Valley company the leader of the productive artificial intelligence boom, Nvidia (NVDA.O), opens new tab, briefly reached $2 trillion in market value on Friday.

Following another impressive revenue prediction from the chip designer, which increased its share of the market worth by $277 billions of dollars on Thursday—the biggest one-day gain on Wall Street in history—came the milestone.

Due to the fact that nearly all generative AI players, including Google and OpenAI, which makes ChatGPT, use Nvidia’s chips, analysts have compared its sharp rise over the past year to that of the picks and shovels suppliers during the 1800s gold rush.

Table of Contents

Due to this, the company’s market value has increased from a value of one trillion dollars to $2 trillion in about eight months, making it the fastest U.S. company to do so and taking less time than technological behemoths Apple (AAPL.O) and Microsoft (MSFT.O) to do the same.

Demand isn’t going to be what will bind today’s top AI companies—they are the industry leaders. Their ability to meet the soaring demand will be their only concern, according to Swissquote Bank senior analyst Ipek Ozkardeskaya.

With Friday’s 0.4% increase in shares, Nvidia’s market value is now approximately $1.97 trillion. After rising more than 16% on Thursday, they had risen a further to be 4.9% to a record-high level of $823.94 before in the session.

The value of the shares more than tripled in 2023, but they have since increased by almost 60% this year. Over a quarter of the increase in the stock index this year can be attributed to the chip designer’s the year 2024 possess surge, which has been critical to the S&P 500 index’s (.SPX) opening new tab gains.

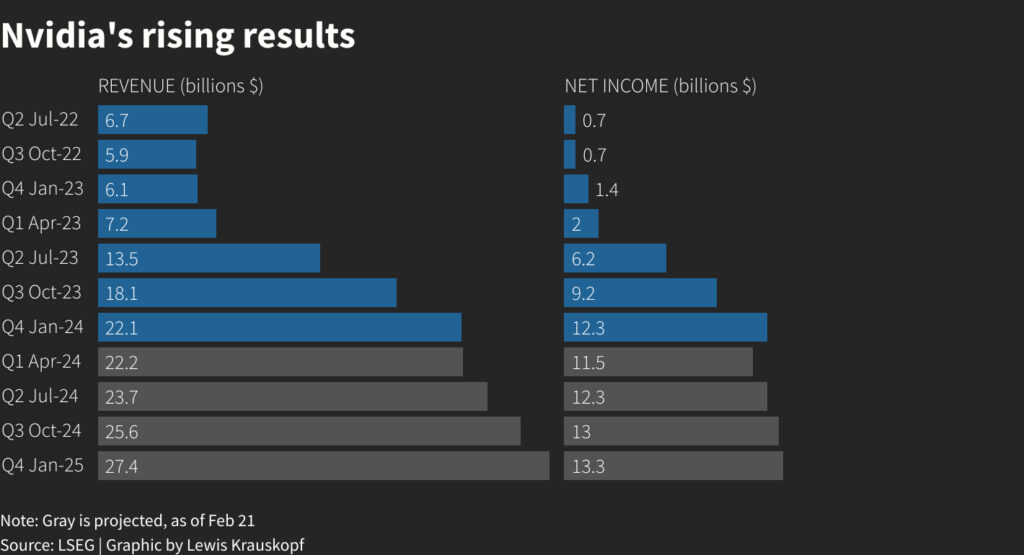

On Thursday, it helped global markets reach all-time highs with its most recent forecast, which beat the market and predicted a staggering 233% boost to first-quarter revenue.

Many analysts and investors have come to Nvidia because of its explosive growth.

“As a fund manager in Europe, I must have received more emails concerning their results than any other group. “There have been calls, and every broker has done 10-minute debriefings; it’s been mind-boggling,” said one investor who declined to be identified.

Rapid rises in analyst estimates have caused Nvidia’s valuation to decline despite the share surge. Using LSEG data, its price-to-earnings ratio for the next 12 months is approximately 31, compared to 49 times a year ago.

“Leading cloud computing companies plan to boost their capital expenditure to satisfy demand for AI training and inference, and it appears that virtually all this spending will fall into Nvidia’s pockets,” said Brian Colello, a Morningstar strategist.

“We anticipate revenue will rise by a couple of billion each quarter throughout fiscal 2025 for Nvidia as more chip supply comes online.”

People also Reading:

Exclusive: Reddit signs AI content licensing deal with Google.

UN chief calls for global AI risk management, warns of ‘serious unintended consequences’.

The SAG AFTRA AI contract raises concerns in the gaming industry.

The metaverse: what is it? An explanation and comprehensive manual.

Microsoft and OpenAI face a copyright infringement lawsuit from The New York Times.

An anti-woke chatbot was the idea Elon Musk promised. Nothing is going as intended.

What is SAFU in the world of Crypto? BTC is moved to a new cold wallet by Binance, funding SAFU.

The Gemini era: Google has finally launched best ever AI model.