Exclusive Chinese companies reportedly hoard top-tier Samsung chips in anticipation of fresh US restrictions.

According to three sources, Chinese IT heavyweights such as Huawei and Baidu, along with startups, are accumulating high bandwidth memory (HBM) chips from Samsung’s electronics division in anticipation of potential U.S. export restrictions on the chips.

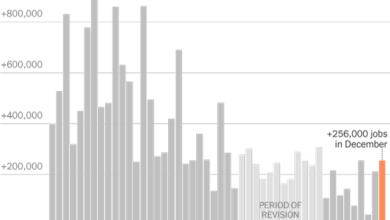

According to one of the sources, since the beginning of the year, the corporations have increased their purchases of artificially intelligent technology (AI) capable semiconductors, enabling China account for roughly 30% of Samsung’s HBM chip sales in the first half of 2024.

Table of Contents

With economic tensions with the United States as well as other western nations on the rise, China is preparing to maintain its technological goals. They also demonstrate the effects of the tensions on the worldwide supply chain for semiconductors.

According to sources cited by news channel last week, export control measures that will place additional limitations on exports to China’s semiconductor industry are scheduled to be unveiled by US authorities this month.

According to those same sources, the package is anticipated to specify guidelines for limiting access to high-bandwidth memory chips. In a statement last week, the US Department of Commerce stated that it is always evaluating the changing threat landscape and revising export regulations “to protect the United States national security as well as protect our technological ecosystem.” The department did not respond to requests for comment.

The development of cutting-edge processors, like Nvidia’s graphics processing units, which can be applied to generative AI tasks, depends heavily on HBM chips.

Only SK Hynix and Samsung, both based in South Korea, and Micron Technology, based in the United States, are the three main chipmakers that produce HBM chips.

According to people acquainted with China’s fascination with HBM, the HBM2E model—which is approximately two generations beneath the most sophisticated version, HBM3E—has been the main focus of Chinese chip demand. The advanced model is becoming harder to come by as a result of the worldwide AI expansion.

According to Nori Chiou, expenditure producer during Singapore-based White Oak Financial backing Partners, “China’s appetite for the company’s HBM has become particularly great, given that its domestic development of technology is not yet fully mature.” Other manufacturers’ capacities have been completely booked by a US citizen AI companies.

The sources claimed that although it is difficult to gauge the quantity or worth of the accumulated HBM chips in China, companies ranging from IT companies like Tencent to satellite manufacturers have been purchasing them. According to one of the sources, Samsung recently shipped HBM chips to chip design firm Haawking.

Meanwhile, one of the sources claims that Huawei has been producing its cutting-edge Ascend AI chip utilizing Samsung HBM2E semiconductors.

Both SK Hynix and Samsung declined to comment. Requests for response from Micron, Baidu, Huawei, Tencent, and Haawking were not answered. The sources requested anonymity because the topic was so delicate.

HBM RIVALS VS SAMSUNG

Chinese companies have made some progress in creating HBM; as previously reported by Reuters, Huawei as well as memory chipmaker CXMT are concentrating on creating HBM2 chips, that are three generation below the HBM3E model.

However, the new American regulation might have an effect on such initiatives. The sources briefed on the sales suggested that Samsung might be more affected by restrictions on HBM supplies to China than its main competitors who depend less on the Chinese market.

As per their statement, SK Hynix, whose primary client for HBM chips is Nvidia, is concentrating more on producing advanced HBM chips, while Micron has not sold any HBM goods to China until last year.

The HBM chips from SK Hynix were practically sold out for 2025 and the company announced earlier this year that it is altering production to increase the output of HBM3E.

People also Reading

TikTok parent files lawsuit for ‘massive-scale intrusions of children’s privacy.’

Nvidia stock rise after a severe sell-off.

China’s ByteDance and Broadcom are collaborating to create a cutting-edge AI chip.

Apple Intelligence: all new AI features coming to the iPhone and Mac.