Fed maintains current rates, announcing three reductions in 2024

The Federal Reserve left its key policy interest rate unchanged for the third straight day on Wednesday, setting the stage for a string of rate cuts beginning in 2024. The policy committee unanimously agreed to keep the benchmark overnight borrowing rate in a targeted range of 5.25 percent to 5.5 percent, even though the economy has remained resilient and inflation has been on a sustained decline.

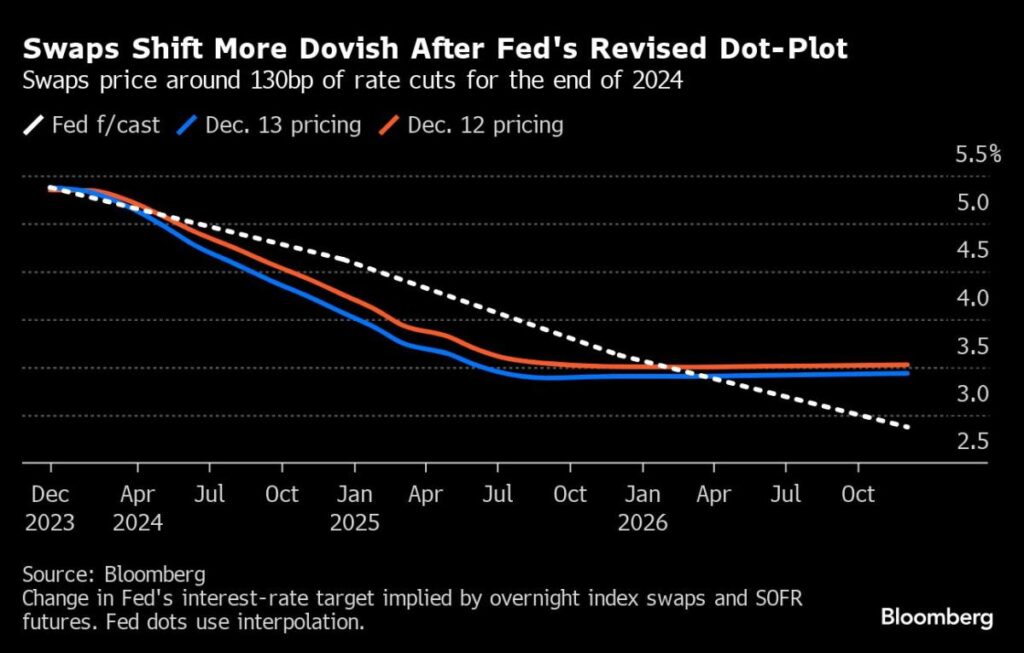

In addition, the committee maintained a neutral stance and projected a minimum of three rate cuts in 2024, including quarter-point hikes. While that’s more aggressive than what officials had previously indicated, it’s still below the market price of four.

The decision to stand pat was widely anticipated by markets, potentially ending a cycle of 11 hikes and lifting the Federal Reserve’s key policy rate to its highest level in more than two decades. But there was some uncertainty about the Fed’s potential appetite for policy loosening.

The Dow’s “handle” index surged by over 400 points, crossing 37,000 points for the first time since the decision was released. According to the committee’s so-called “dot plot” of individual members’ expectations, a full percentage point (or four more cuts) is projected in 2025. The Fed’s long-run forecast is for the fed funds rate to reach the “neutral” range of 2.25–2.5% with three additional cuts through 2026, although estimates for the past two years have varied wildly.

However, the markets priced in an even more violent rate-cut path after the meeting was over and Chair Jerome Powell’s press conference, expecting a point and a half in decreases next year, which is double the FOMC’s indicated pace.

The statement stated that the board would consider various factors for “any” additional policy tightening, which may be interpreted as a nod that the hikes are finished. This wording had not been used before.

“The Fed has indicated a possible thawing of thawed high borrowing costs over the coming weeks and months, even though it’s still cold outside,” stated Rick Rieder, the investment chief of worldwide fixed-income assets at massive asset management company BlackRock.

In addition to raising interest rates, the Fed has also been letting proceeds from evolving bonds roll off its reserves at a rate of up to ninety-five billion dollars per month. The Fed has not shown any signs of wanting to stop that particular aspect of its policy-tightening. Such process has continued.

Table of Contents

Over the past year, inflation has Eased

The developments coincide with an improving inflation picture after inflation reached a 40-year high in the middle of 2022.

“Without a discernible rise in unemployment, inflation has decreased from its peak. At a press conference, Chair Jerome Powell stated, “That’s very good news.”

The post-meeting statement used new language that echoed that. The committee kept calling prices “elevated,” but added a caveat that inflation has “eased over the past year.” According to Fed officials, core inflation will drop to 2.4% in 2024 and 3.2% in 2023 before reaching 2.2% in 2025. In 2026, it eventually returns to the 2% goal.

This week’s economic data revealed that November’s consumer and retail costs barely changed. However, the Fed is getting close to its 2% inflation emphasise by some measures. According to Bank of America’s calculations, the Fed’s preferred inflation gauge is expected to be 3.1% compared with the previous year in November. In fact, it may reach a 2% six-month annualised rate, which would satisfy the central bank’s objective.

In addition, the statement stated that the economy “has slowed,” contradicting the November claim that activity had “expanded at a strong pace.”

At the press conference, Powell stated: “It appears that the third quarter’s abnormally fast growth in the economy has slowed down significantly. Nevertheless, the GDP is expected to grow by 2.5% overall this year.

The committee revised the forecast for the gross domestic product, which increased by half a percentage point from the previous September update to 2.6% annualised pace in 2023. According to officials, the GDP will grow by 1.4% in 2024, essentially staying the same as before. The unemployment rate was predicted to be 3.8% in 2023 and to rise to 4.1% in the following years, essentially staying the same.

Authorities have emphasised that if inflation picks up steam, they are prepared to raise rates once more. When they observe the effects of the prior policy tightening measures on the US economy, the majority have stated that they can now exercise patience.

President Joe Biden has suffered politically as a result of persistently high prices. This is largely due to public disapproval of his handling of the economy. The possibility that the Fed would be hesitant to implement any significant policy changes in 2024—a year that coincides with a presidential election—had been raised.

Nonetheless, the Fed would be tempted to take action if the data on inflation persisted because real rates—that is, the gap between the money supply rate and inflation—are currently high.

Analysts now expect the market to see the inaugural rate cut in the month of March, but this could be too soon.

What Powell, the Fed Chair, says?

Jerome Powell, the chairman of the Federal Reserve, surprised analysts on Wednesday by giving a press conference that was perceived as significantly more dovish than anticipated.

U.S. economist Michael Feroli of JPMorgan Chase described it as “12 doves a-leaping.”

“The Fed is amazed by its good fortune, “The data is going in their direction,” Evercore ISI vice chairman Krishna Guha said.

The Fed’s statement and economic projections at 2:00 PM Eastern time were the first indications of dovishness. To start, the Fed revised its September projections for rate cuts to three in 2024 from two. By hinting that they were considering the possibility of “any” more hikes, the Fed further moderated its tightening stance.

Then, in a note sent to clients, Feroli stated at the press briefing thirty minutes later that “Chair Powell did not much to undo the perception of those signals.” Powell stated that the Fed was beginning to talk about when to lower interest rates.

Powell stated, “It was evident that the matter of when it would be acceptable to start reducing the policy restraint” was “a conversation for us at our meeting today.” The Fed is “probably at or near the maximum rate for this cycle,” according to Fed officials.

Rate cuts are “collecting dust,” according to Michael Gregory, deputy economist in charge at BMO Capital Markets, even though Powell did not take them “off the table.”

The 10-year Treasury yield, BX: TMUBMUSD10Y, dropped to 4.025% as a result of market reactions.

Derivatives market traders now project five quarter-point rate cuts in the upcoming year, with an 80% probability of the initial rate cut in March.

The key takeaway from Wednesday’s press conference, according to Deutsche Bank chief U.S. economist Matt Luzzetti, was that Fed Governor Chris Waller’s dovish remarks from a few weeks ago represented the central bank’s mainstream viewpoint rather than those of a dovish outsider.

Waller suggested that if inflation continues to slow down, rates could be lowered by spring in a speech he gave late last month.

March is too soon, according to some economists, to lower interest rates.

“We continue to believe that rate cuts will begin later instead of sooner, by the completion of the third period of 2024,” Gregory of BMO Investments stated.

Having previously predicted a July rate cut, Feroli now sees the initial rate cut occurring in June and believes the Fed will decrease rates multiple times by the year’s end of 2024.

According to Luzzetti of Deutsche Bank, there will be six rate cuts in 2019; however, they won’t start until June due to a mild recession in the economy.

Recession forecasts are not made by the Fed. Its rate reductions are solely motivated by declining inflation. According to Luzzetti, the Fed will make rapid cuts if a recession occurs.

The likelihood of a recession has decreased, according to Diane Swonk, the head of economics at KPMG, since the Fed has indicated it will actively work to prevent one.

According to Swonk, the Fed no longer wants an arrival and instead encourages the marketplace to cruise at less elevation.

Powell’s communication in Jackson Hole, Wyoming, in the summer of 2022, which lasted less than ten minutes but warned of “pain” and the unfavourable costs of fighting inflation, is a complete 180-degree turn from that. At the time, the stock market was in a panic after Swonk described the speech as “a bucket of ice water.”

Will rates be lowered by the Fed in 2024?

Given the three consecutive pauses and the declining rate of inflation, further hikes are unlikely. Although the economy is still susceptible to outside shocks, the FOMC’s forecasts reflect a more dovish outlook than they have in a while. Once more, the committee projects that there may be three rate reductions in the upcoming year.

The Fed will keep an eye on the labour market, inflation, and economic growth—all of the usual suspects.

The exact date of the first rate reductions in 2024 is unknown. In light of the announcement made today, the CME FedWatch Tool for the futures market indicates that another pause is anticipated at the end of the Fed’s upcoming meeting on January 31.

It’s important to remember that the effects of the Fed’s decisions frequently last, so even after the Fed starts reducing interest rates, consumers may continue to be affected by this year’s rate hikes.