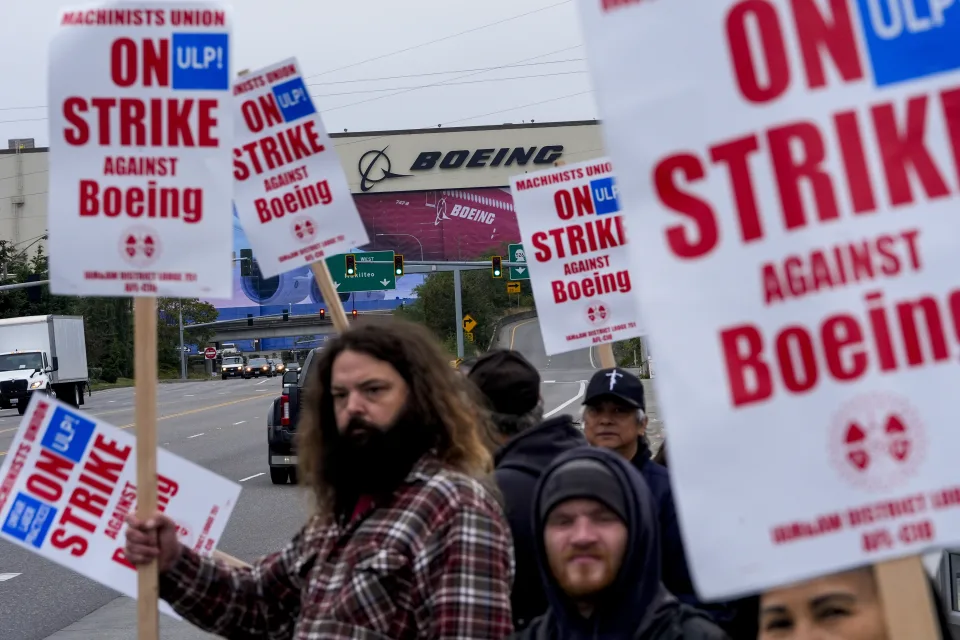

Boeing to eliminate 17,000 jobs, delay first 777X jet as strike impacts finances.

Boeing is set to cut 17,000 jobs, which constitutes 10% of its global workforce, delay the initial deliveries of its 777X jet by a year, and announce a $5 billion loss in the third quarter as the American aircraft manufacturer grapples with the repercussions of a month-long strike.

In a note to staff, CEO Kelly Ortberg stated that the substantial layoffs are required “to align with our financial reality” following the construction of the company’s 737 MAX, 767, and 777 aircraft being suspended by a battle involving 33,000 American West Coast workers.

“We reduced the size of our team to better reflect our financial situation and priorities our goals. We want to cut our overall headcount by around 10% in the upcoming months. In the message from Ortberg, it was said that executives, managers, and workers will all be let go.

Table of Contents

1.1% was lost by Boeing shares in after-market trading. The extensive adjustments are a significant step for Ortberg, who took over the troubled plane maker in August on a pledge to mend fences with the union & its workers.

Pre-tax earnings charges totaling $5 billion were reported by Boeing for its two commercial aircraft programs and defense sector. Ted Colbert, the leader of Boeing’s problematic space and defense division, was fired on September 20.

In a separate statement, Boeing, which releases its third-quarter earnings on October 23, stated that it now projects revenue of $17.8 billion, a $9.97 loss per share, and a $1.3 billion better-than-expected negative operational cash flow.

Based on LSEG data, analysts had projected Boeing to have a negative $3.8 billion quarterly cash burn. Great Hill Capital’s equities manager, Thomas Hayes, stated that the layoffs might incentivize workers to call off their walkout.

Boeing Faces Troubled Times with 17,000 Job Cuts, 777X Delay and $5 Billion Quarterly Loss

“Striking workers who temporarily do not have a pay cheque do not want to become unemployed workers who permanently do not have a pay cheque,” Hayes wrote in his email. “I would estimate the battle will be resolved within a week as these workers do not want to find themselves in the next batch of 17,000 cuts.”

A settlement to terminate the work stoppage is imperative for Boeing, since the company has accused the machinist union of acting dishonestly in an unfair labor practice complaint filed with the National Labour Relations Board on Wednesday. Boeing is reportedly losing $1 billion a month as a result of the battle, according to ratings agency S&P, and it could also lose its coveted investment-grade credit rating.

Ortberg added that because of difficulties in development, the suspension in flight testing, and the labor stoppage, Boeing has informed clients that it now anticipates initial delivery of the 777X in 2026. The 777X’s certification problems that Boeing had already encountered had caused a major delay in the aircraft’s takeoff.

“While our business is facing near-term challenges, we are making important strategic decisions for our future and have a clear view on the work we must do to restore our company,” Ortberg stated.

After completing and delivering the final 29 ordered aircraft in 2027, Boeing will terminate its 767-freighter program; nevertheless, it has stated that KC-46A Tanker production will go on.

The union that represents striking employees, the International Union of Aerospace and Machinists Workers (IAM), stated in a statement that it was concerned about Boeing’s decision regarding its 767 commercial freighter and that it will evaluate its ramifications. Additionally, IAM deemed as baseless Boeing’s allegations made to the National Labour Relations Board against the union.

It stated that the organization’s “failure to come back to the bargaining table regarding its front workers” appeared to be the main focus of both those allegations and the cancellation of the 767-freight plane.

The statement from this aerospace company stated that trying to negotiate in the press “won’t work and in fact is damaging to the bargaining process,” according to Jon Holden, Chairman of IAM District 751. He added that continuing the battle would only be futile if negotiations were avoided. In response to the layoffs, this largest aerospace company declared that it would discontinue its September-announced paid leave program.

The firm was losing money even before the Sept. 13 battle started because it was still trying to recuperate from a mid-air panel burst on a new plane in January that revealed lax safety procedures and forced US regulators to halt production.

Under an agreement with the Justice Department, this largest aerospace company offered to plead guilty to fraud. However, the judge hearing the case in Texas on Friday will determine whether to accept the maker’s offer.

Boeing has consented to pay a maximum punishment of $487.2 million, invest a minimum of $455 million in enhancing safety, and be subject to independent oversight and three years of probation under court supervision.

Additionally on Friday, a national watchdog declared that the Federal Aviation Administration’s management of Boeing production was “not effective”. This week, a news agency revealed that aerospace company is exploring ways to generate billions of dollars by selling shares and securities resembling equity.

The reports state that these alternatives include offering preferred equity and obligatory convertible bonds in addition to common stock. According to one of the individuals, they recommended that Boeing raise about $10 billion.

The business reported operational cash flow deficits of almost $7 billion for the initial half of 2024, and it owes over $60 billion in debt.

According to analysts, world’s largest aerospace company would have an increase between $10 billion as well as $15 billion in order to keep its current rating of one notch above junk.

According to Michael Ashley Schulman, a partner at Running Point Capital Advisors, the labor downsizing and the postponement of the 777X delivery were anticipated events.

“Their credit rating and share price has been at risk for the better part of a decade because of mismanagement and the stubbornness displayed in the battle may be the straw that breaks the camel’s back,” he stated.

People also Reading

Boeing’s Latest Move: Stopping Union Negotiations and Retracting Pay Offer

Futures Edge Upward as Inflation Data and Earnings Reports Loom

Blowout US job report boosts economy’s resiliency.