Futures Edge Upward as Inflation Data and Earnings Reports Loom

Tuesday saw gains in U.S. stock index futures following a selloff in the day before as investors awaited new information on the trajectory of interest rates from important inflation data and the upcoming third-quarter earnings season, which begins later this week.

Due to pressure from rising Treasury rates, worries over the effects of growing Middle East turmoil, including a repricing of the US rate expectations, all three main indices ended the day down by roughly 1%.

Table of Contents

The Dow E-mini was up 70 points, as well as 0.17%, US S&P 500 E-minis was up 20 points, as well as 0.35%, and Nasdaq 100 E-minis had been up 75.75 points, as well as 0.38%, at 5:35 a.m. ET.

Although the return on the standard 10-year note stayed over 4%, U.S. Treasury yields modestly declined from their highs on Monday as investors reduced their wagers on the extent of the Federal Reserve’s interest rate reductions for the remainder of this year in response to robust economic data last week.

Traders have factored in a roughly 89% probability that the Fed would decrease interest rates by 25 basis points during its meeting in November. According to CME FedWatch, the odds on there being no rate hike during the meeting also slightly increased.

Dow and S&P Gain as Investors Seek Clarity on Interest Rate Path

According to CFRA Research senior investment strategist Sam Stovall, “with gains for six of its 11 sectors,” the S&P 500 is anticipated to report a 3.2% year-over-year increase in profits per share (EPS) in the third quarter.

Federal Reserve Governor Adriana Kugler stated earlier on Tuesday that if prices continue to decline as she anticipates, she would be in Favour of additional interest rate reductions.

On Monday, some Federal Reserve officials, such as Alberto Musalem and John Williams, stated that gradually lowering rates would be suitable. Raphael Bostic, Susan Collins, and Philip Jefferson are among the other Fed officials scheduled to appear later today.

Later on, Tuesday, international trade balance statistics for August is also anticipated. Investors were also keeping an eye on how Hurricane Milton, a category 4 storm, will affect the markets.

Honeywell International’s shares increased 2.9% among single stocks following news that the company intends to split off its technologically advanced materials division.

A lack of further specifics caused investors’ euphoria over China’s stimulus efforts to wane, and U.S.-listed stocks of Chinese companies fell, mirroring losses in domestic stocks. Alibaba Group, JD.com, and PDD Holdings all had share price declines ranging from 8.3% to 10.8%.

Tuesday’s surge in Chinese shares petered out due to unclear facts surrounding China’s much-anticipated fiscal stimulus, which also caused Hong Kong equities to plummet and negatively impacted European businesses and oil prices.

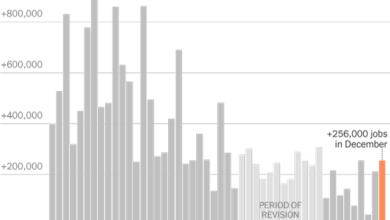

In addition, there were other forces at work as investors closely monitored the intensifying Middle East conflict and the anticipated rate-cutting trajectory of the Federal Reserve following a strong Friday job report.

After a week-long National Day holiday, China’s markets reopened, and the country’s CSI300 blue-chip index jumped 10% in early trade to reach its highest level since July 2022.

However, the index reversed course and ended 5.9% higher when Zheng Shanjie, the chairman of China’s economic planner, offered scant details about new fiscal stimulus to support the monetary stimulus package that was unveiled two weeks prior.

Profit-taking and fading investor patience were evident when Hong Kong’s Hang Seng Index fell 9.4%, throwing up some of the significant gains it achieved during the Chinese vacation.

Markets were anticipating some indication on the magnitude of fiscal stimulus, according to East Spring Investments portfolio manager Rong Ren Goh. The market’s reaction to the announcements thus far is probably consolidation and assimilation of the information, which is significant but not sufficient to meet high expectations.

Luxury and China-sensitive mining businesses were among the worst losers as European markets slumped. The FTSE 100 plummeted 1.3%, the German DAX declined 0.8%, and the Stoxx 600 index for the entire continent dropped 0.9%.

“Basically, the markets were expecting China to reveal a little bit more information about the fiscal stimulus measures,” WisdomTree director of macroeconomic analysis Aneeka Gupta said. Since they reopened today, it is evident that the plan did not work out, and I believe this is slightly depressing European stocks.

A 1% decline in U.S. stocks on Monday, primarily due to a decline in IT companies, was also leading Europe as anxiety over Fed rate reduction and developments in the Middle East increased.

The escalating Middle East war and worries about supply interruptions from US storms caused oil prices to retreat somewhat from their Monday surge. The previous session saw Brent crude futures rise above $80 a barrel for the initial time in more than a month; nevertheless, they were down 1.9% at $79.41 a barrel.

Monday saw Hezbollah launch rockets towards Haifa, the third-largest city in Israel, and, a year after the catastrophic Hamas attack on Israel that precipitated the Gaza War, Israel appeared ready to extend its offensive into Lebanon.

According to Gupta, the most important questions are whether Israel will attack Iran’s oil production facilities in retaliation for its missile attack last week and how China’s stimulus plan will affect the world’s energy demand.

Following the unexpectedly positive U.S. jobs data on Friday, rates on benchmark 10-year US government bonds increased over the previous two sessions and were now hovering above the 4% mark.

Now, traders are factoring in a roughly ten percent possibility that the Fed may decide to maintain rates the following month and that rates will drop by around fifty basis points during the remainder of the year. In contrast to the euro, which was up 0.1% at $1.0985, the dollar was weaker, down 0.27% to 147.78 against the Japanese yen.

People also Reading

Japan leads Asia’s stock gain, but the dollar strengthens amid massive US payrolls.

Blowout US job report boosts economy’s resiliency.

Stocks Struggle While China Thrives on Stimulus Boost