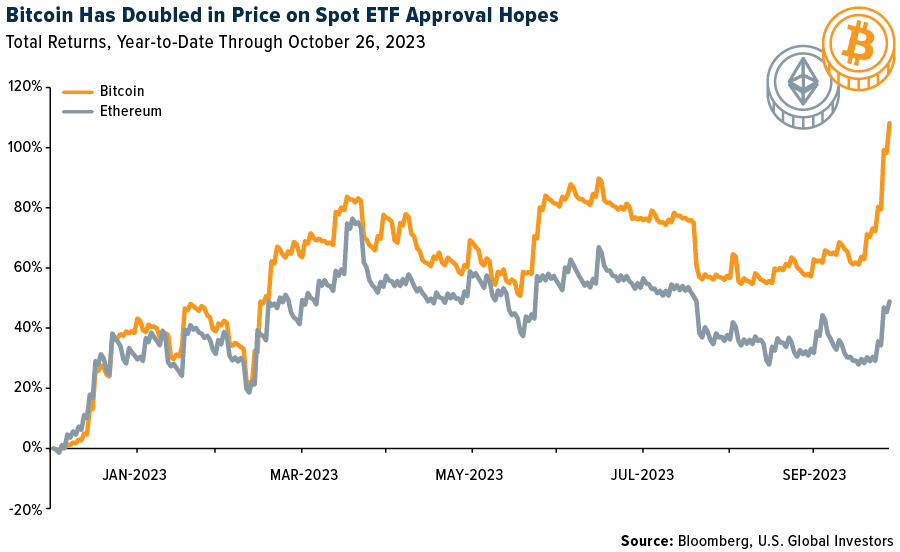

Bitcoin approaches to its high for the first time since April 2022.

The world’s largest cryptocurrency, bitcoin, kicked off the start of the year with a smash on Tuesday, January 2, breaking above US$45,000 for its first occasion since April 2022. This surge was fueled by optimism regarding the potential authorization of exchange-traded detect bitcoin funds.

After rising 156% in the previous year, cryptocurrency reached a 21-month high of US$45,532, marking its best annual performance since 2020. Although it recently increased by 2.5% to US$45,318; it is still far below the all-time high of US$69,000 that it reached in November 2021. The coin associated with the Ethereum blockchain, ether, surged 91% in 2023 and was 1.45% greater at US$2,386 on Tuesday.

Table of Contents

The primary concern among investors has been the potential approval of a spot bitcoin ETF by the US securities regulator. This approval could potentially attract billions of dollars in investments and expand the marketplace for bitcoin to millions of new players. In recent years, the US equity regulator has denied numerous requests to introduce spot bitcoin exchange-traded funds (ETFs), citing the market’s susceptibility to manipulation.

Yet there have been more indications in recent months that authorities are ready to approve at least a few of the 13 suggested detect bitcoin exchange-traded funds (ETFs). It is anticipated that the choice will be made in early January. Chris Weston, the chief of statistical analysis at Pepperstone, predicted a clear-cut response and an instant decline in value in the event of a rejection.

“However, should we see the green light the obvious question is whether we get a buy the rumour, sell-on-fact scenario playout or whether it promotes another leg higher,” he wrote in a note. Growing expectations that the main banks will lower rates of interest this year have additionally assisted cryptocurrencies rebound from the pessimism that shrouded the market after FTX’s collapse and other cryptocurrency-related failures of businesses in 2022.

According to Jupiter Zheng, partner of liquid funds at HashKey Capital, “the crypto market is set to experience notable growth this year, with key influencing factors being the influx of investment funds from spot ETFs, Bitcoin halving, and a more accommodative monetary policy both in the United States and worldwide.”

Due to hopes for ETF approval, Bitcoin reaches its greatest level in 21 months.

As the expectation of an ETF (exchange-traded fund) that would invest directly in the largest token growing, Bitcoin crossed US$45,000 for the initial time in almost two years.

At 9.45 a.m. Singapore time on Tuesday, the cryptocurrency was trading at US$44,844, having surged as much as 4% to reach its highest point since April 6, 2022. Other tokens saw gains as well; Ether, the second largest, increased by 2.6%. With the US Securities as well as Exchange Commission’s Jan. 10 deadline to approve a bitcoin spot ETF approaching, the price of bitcoin has increased by more than 15% since the beginning of December.

Ahead of the impending approval, investors have begun “buying on Jan 1, promptly on New Year’s morning,” according to Hayden Hughes, co-founder of social trading site Alpha Impact. This is because certain investors in the US as well as Europe are afraid of missing out. Trading on the spot optimism for ETFs, traders anticipate bitcoin to reach US$50,000 in the near future.

The surge in bitcoin prices over the past year has also been fueled by a generalized optimism about risk, which has been stoked by predictions of US interest rates falling. The sharp decline that rocked the cryptocurrency market in 2022 has been somewhat mitigated by the current upsurge. The token is still below its record of nearly US$69,000. Set during the pandemic in 2021.

Related Posts of Author

The Rise of Bitcoin: A Comprehensive Analysis and Present Situation

Toshiba delists amid a crisis after 74 Years