End of Boeing Strike in Sight? Workers to Vote on Latest Wage Offer

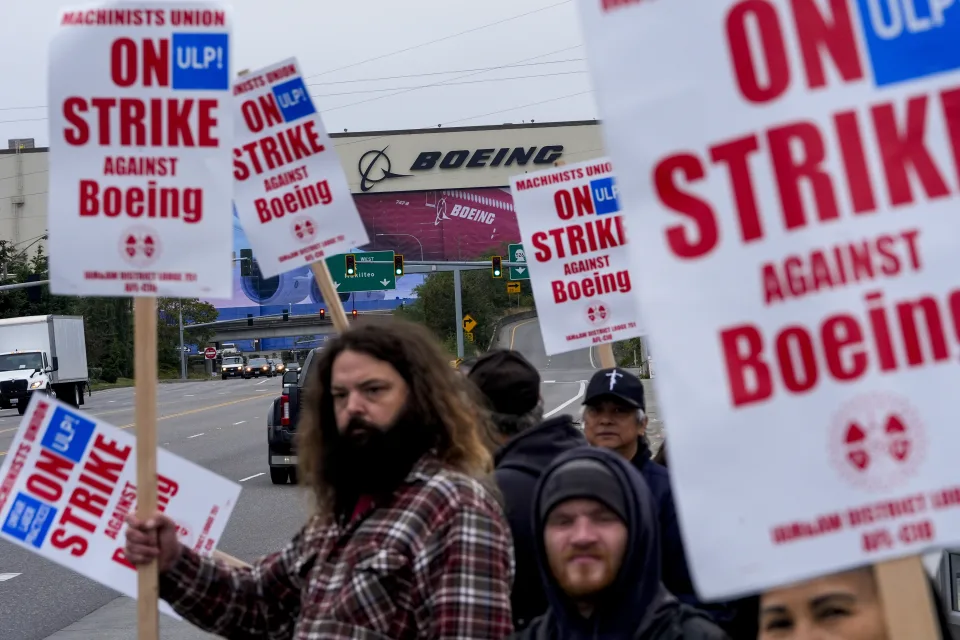

Boeing -0.20% and its striking labor union have come to a new tentative deal that could put an end to the month-long strike that has stopped production of a number of goods, including Boeing’s 777 and 737 MAX aircraft. Extend the contract’s duration and other benefit upgrades. A majority must approve the agreement in order to end the strike.

After dismissing a proposal on September 12, some 33,000 employees in the Pacific Northwest left their jobs on September 13. A four-year pay raise of roughly 25% was part of the proposal. A proposal to put a vote on a roughly 30% increase in basic pay was turned down by union leadership. Base pay would rise by almost 35% as a result.

Table of Contents

A $7,000 confirmation bonus is also included in the revised proposal. The union was hoping for a return to fixed benefit pensions, but the firm refused. 401(k) plans instead need a $5,000 one-time payment. Moving forward, the business will match contributions made by employees up to 8% of their yearly salary. Additionally, Boeing matches 4% of an employee’s pay into the program.

By the time the contract expires in early September 2028, certain of the highest-paid and most experienced workers would have hourly pay of nearly $70 due to the base wage hikes. That’s around $140,000 annually before overtime pay and other bonuses. To combat inflation, there is a 12% wage increase immediately.

The sides were met by acting Labour Secretary Julie Su earlier in the week. The log jam might have been broken by her assistance.

A negotiated plan and resolve to stop the strike have been obtained with the assistance of Secretary Su, the union stated in a post on X on Saturday. “It merits your consideration and a presentation to the members.” Boeing expressed its excitement about its employees’ feedback on the negotiated deal in an email statement.

Boeing Workers on strike will now vote on the agreement.

Investors desire an end to the strike. Boeing needs to build aircraft in order to generate revenue, but it has enough cash on hand to weather the stoppage. Since 2018, Boeing has not produced a profit for the entire year.

As of Friday’s trading, the shares of Boeing have lost almost 41% of its value this year and roughly 38% since a 737 MAX 9 aircraft’s emergency door plug came out on January 5 while the plane was in flight.

Investors should anticipate a favorable response to the Monday trading development. Prior to the strike, shares were trading at roughly $163. On Friday, they closed at $155.

Naturally, pay rises increase costs, but wage increases were anticipated by investors. According to Wall Street projections, the additional cost by contract’s conclusion would come to roughly $1.4 billion annually. The management of this largest aerospace company recently said that it would be laying off roughly 17,000 employees. This action saves about $2 billion in annual costs.

The termination of the strike also makes room for the anticipated cash raise from investors. Just the timing is better. Selling shares is much simpler for a business when there isn’t a strike.

This largest aerospace company has submitted documentation to the Securities and Exchange Commission in an effort to raise up to $25 billion through a combination of debt-like securities and equity. A $10–$15 billion equity sale is anticipated by investors to support the company’s failing financial sheet.

After two fatal incidents, the 737 MAX aircraft was grounded globally between March 2019 as well as November 2020. At that time, the company’s long-term debt had increased by over forty billion dollars until its closing of 2018.

Boeing’s management believes that maintaining the company’s investment-grade credit rating is crucial, and more cash will help achieve this goal.

People also Reading

Boeing to eliminate 17,000 jobs, delay first 777X jet as strike impacts finances.

Futures Edge Upward as Inflation Data and Earnings Reports Loom

Japan leads Asia’s stock gain, but the dollar strengthens amid massive US payrolls.