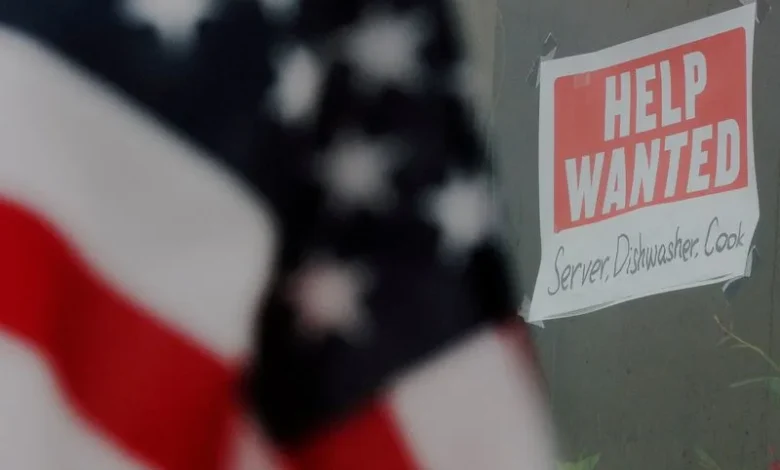

Blowout US job report boosts economy’s resiliency.

A robust economy suggests that the Federal Reserve may not need to implement significant interest rate reduction for the remainder of this year, as seen by September’s record-breaking surge in US job growth and a drop in the unemployment rate to 4.1%.

Wages increased at a strong rate in May, in addition to the Labour Department’s nonfarm payrolls reporting a larger-than-expected increase on Friday. The carefully followed employment report also revealed that, contrary to expectations, the economy added 72,000 additional jobs in July and August.

Table of Contents

The yearly benchmark changes to the national account’s statistics last week, which upgraded growth, income, savings, and corporate profits, revealed the economy is in far better health than previously thought. These revisions came just a week before the report.

Federal Reserve May Not Need to Cut Interest Rates Amid Robust Job Growth and Falling Unemployment

Federal Reserve Chair Jerome Powell acknowledged the robust economic climate this week, dismissing traders’ anticipations of an additional half-percentage-point rate reduction in November. He clarified, “This is not a committee that is inclined to rapidly lower rates.”

“Today’s report reinforces the theme of resilience in the US economy, setting aside concerns about a potential downturn in labor market conditions,” said Jonathan Millar, a seasoned economist at Barclays. “We stand by our prediction for a 25-basis point reduction in November.”

The Labour Department’s Bureau of Labour Statistics noted that last month’s growth in nonfarm payrolls of 254,000 jobs was the most since March. Payrolls increased by 140,000 positions, according to Reuters polled economists, compared to the previously reported 142,000 positions gained in August.

Between 70,000 and 220,000 jobs were predicted to be added in September. August’s 140,000 monthly job growth rate was surpassed by August’s 186,000 three-month average. From 51.8% in August to 57.6% in September, the percentage of industries reporting higher payrolls increased.

Following the U.S. central bank’s unusually hefty 50 basis point rate cut last month to launch its policy easing cycle, a stream of positive data, notably consumer spending, has some economists questioning whether policymakers have gone crazy.

According to Kyle Chapman, an FX markets researcher at Ballinger Group, “it is highly probable that the Fed would’ve went for a 25- basis point change instead if they had known about the adjustments to the August and July prints in advance.”

When compared to a basket of currencies, the dollar surged to a seven-week high. Wall Street stocks were mainly up. Bond rates in the US increased.

According to CME Group’s FedWatch tool, financial markets increased their bets on a quarter-percentage-point rate drop in November to 95% from 71.5% prior to the announcement. The probability of a 50-basis-point reduction was nearly eliminated.

For the first time since 2020, the Fed lowered its benchmark interest rate by fifty basis points last month, to a range of 4.75% to 5.00%. In 2022 and 2023, it climbed by 525 basis points.

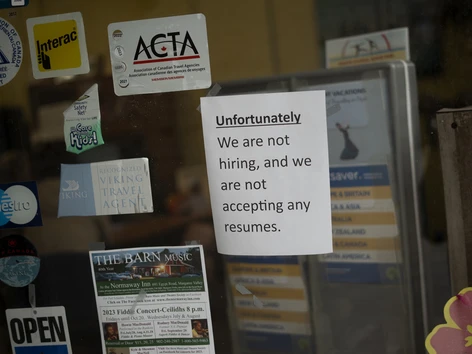

October Look, Muddy

Nonetheless, given that Hurricane Helene ravaged a significant portion of the US Southeast last week, there may be some transitory volatility in the labor market. In September, tens of thousands of Boeing machinists went on strike, which had an impact on the suppliers of the aerospace company.

If the strike lasts until next week, it will affect the October nonfarm payroll figures, which are scheduled to be announced a few days before the U.S. presidential election on November 5.

The primary concern among voters has been inflation, despite the fact that pricing pressures have significantly decreased following their 2022 surge.

Strong job growth last month disregarded the negative outlook for the labor market as reported in surveys by the Conference Board and the Institute for Supply Management (ISM). The virtually universal increase in payrolls was led by the hiring of 69,000 new employees at pubs and restaurants.

Hospitals, nursing homes, and residential and assisted living institutions were the main employers in the healthcare sector, accounting for 45,000 new jobs.

The hiring of state and municipal governments contributed to a 31,000 increase in government employment. Payrolls for social assistance increased by 27,000 jobs. The number of jobs in the construction industry increased by 25,000, primarily due to increases in specialty trade contractor jobs that are not residential.

Fifty-six thousand new employment were added by retailers, primarily in pharmacies and supermarkets. Along with financial activities, professional and commercial services had job improvements as well.

However, the manufacturing sector lost 7,000 jobs, mostly in the auto sector. 8,600 were lost in transportation and warehousing, the majority of them in warehouses as well as storage facilities.

Solid Wage Incomes

Average hourly earnings increased by 0.4% following a 0.5% increase in August because to a combination of strong hiring and low layoffs. After increasing 3.9% in August, wages increased 4.0% annually. However, the average workweek decreased from 34.3 hours to 34.2 hours in the previous month. Growing salaries did not worry economists about inflation resuming.

Nevertheless, they argued against the Fed cutting rates by another half-percentage-point during its meeting on November 6-7. At that meeting, policymakers will be armed with October’s assessment, which has probably been tainted by Helene as well as the Boeing strike.

Michael Pugliese, a senior economist at Wells Fargo, remarked, “The firming observed in September is not perceived as a threat to the ongoing decline in inflation.” He added, “The labor market appears to continue its gradual cooling, and an increase in productivity growth is further mitigating the inflationary pressures originating from the labor market.”

The household survey, which provides the unemployment rate, revealed similarly positive details, despite the fact that 121,000 additional individuals were employed in several capacities. The decrease in the rate of joblessness from 4.2% in August was caused by an increase in household employment of 430,000 jobs, which more than offset the 150,000 new hires.

In April 2023, the unemployment rate was 3.4%. However, during the yearly factory shutdowns in July, there was an increase in temporary layoffs, mostly due to the 16–24 age group.

It has now dropped for the past two months in a row. As a gauge of an economy’s capacity to generate jobs, the employment-to-population ratio increased from 60.0% in August to 60.2%. For financial reasons, the number of part-timers decreased.

“After several turbulent months, the labor market is returning to a state of equilibrium,” declared Oscar Munoz, Chief U.S. Macro Strategist at TD Securities.

People also Reading

Market Futures Mixed: Key Labor Data and Powell’s Rate Cut Signals in Focus

Stocks Struggle While China Thrives on Stimulus Boost

Qualcomm’s Bold Move: Is a Takeover of Intel on the Horizon?