Qualcomm’s Bold Move: Is a Takeover of Intel on the Horizon?

Is a Qualcomm-Intel merger in the works? Discover the strategic rationale behind Qualcomm’s CEO Cristiano Amon’s bold statements and the potential impact on the competitive landscape of the business technology sector.

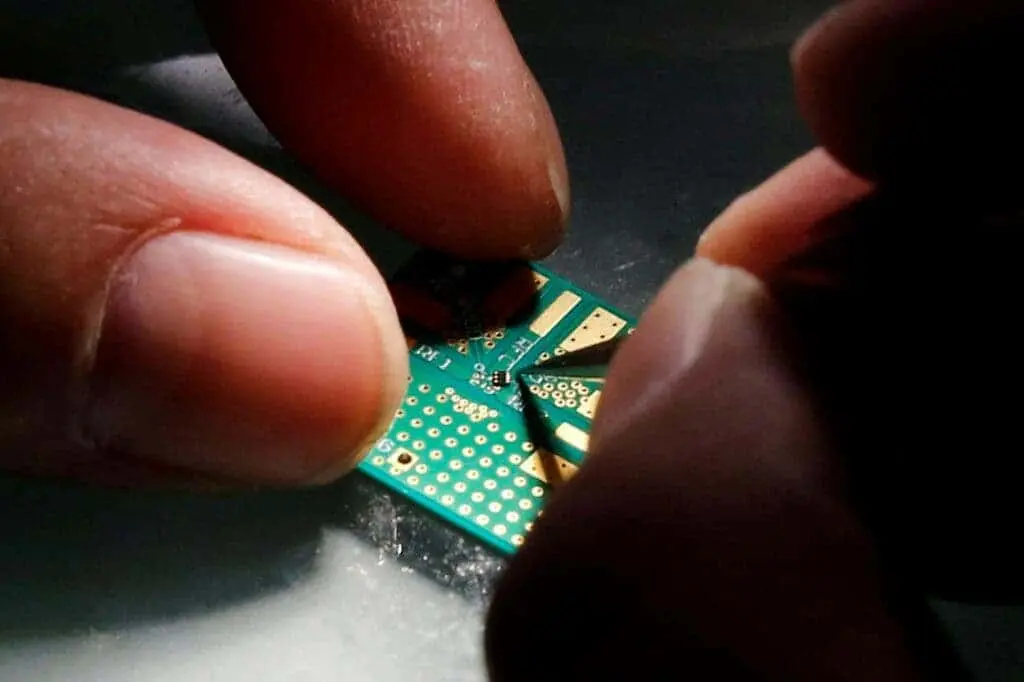

An individual with knowledge of the matter stated on Friday that Qualcomm has reached out to Intel in recent times to discuss the possibility of purchasing the struggling chipmaker. This might be a game-changing transaction for the industry, but it will not be easy to pull off.

Table of Contents

Qualcomm CEO’s Bold Statements Hint at Intention to Acquire Intel

The person with knowledge of the talk’s claims that Qualcomm CEO Cristiano Amon is actively participating in the talks to buy the fifty-year-old Intel. Amon has been aggressively exploring other options for a transaction for the company, according to a second person with knowledge of the matter.

Qualcomm looked into buying parts of Intel’s design division earlier this month, according to a news source, with its PC design unit being of special interest. Executives from Qualcomm were looking over Intel’s whole line of operations.

The talks with Intel are still in the early phases. Based on information from a third party familiar with the situation, the San Diego-based business has not made an official offer for Intel.

Since the conversations are private, the sources asked to remain anonymous. Intel opted not to respond. An inquiry for comment from Reuters was not immediately answered by the chipmaker comany. Qualcomm’s stock dropped 2.9%, while Intel’s finished 3.3% higher.

Qualcomm’s attempt coincides with a vulnerable period for Intel, the world’s most valuable chipmaker before its shares plummeted by around 60% since the year’s beginning.

Should a transaction proceed, antitrust authorities in China, Europe, and the US would probably investigate it closely. To get approval from regulators, Qualcomm might have to sell off a portion of Intel.

The proposed acquisition would be the largest in the tech sector since Broadcom’s attempt to acquire Qualcomm for a total of $142 billion in 2018. However, the deal was scrapped by President Donald Trump due to concerns over national security.

The $188 billion market value of Qualcomm made it impossible for a news agency to calculate how it would pay for an offer to purchase Intel, which is worth $122 billion when debt is taken into account.

Recent company filings indicate that Qualcomm has approximately $13 billion in cash. How this chipmaker company would manage the acquisition of Intel’s contract manufacturing division is likewise unknown.

Intel has spent several hundred billions of dollars throughout the years refining its fabrication process as well as hiring many thousands of technicians to create chips with the highest possible degree of perfection. Up until 2026, the chipmaker company will provide Apple with 5G chips.

Currently, the chipmaker company uses designs and other technology from Arm Holdings and contracts with companies like Taiwan Semiconductor Manufacturing Co.; it has never run its own chip production, or fab.

Intel’s issues

As Nvidia and AMD benefited from the generative AI boom, Intel, once the industry leader in chipmaking, lost its manufacturing advantage to rival TSMC of Taiwan and was unable to create a chip that was in high demand.

In an effort to revive its company, Intel has been concentrating on artificial intelligence (AI) processors and establishing a foundry—a company that contracts to make chips.

Following a board meeting this week, Intel made a number of announcements, which were included in a memo from the chief executive officer Pat Gelsinger.

A news source previously stated that Gelsinger along with other executives offered a strategy to restructure the corporation and trim off operations. The corporation intends to sell off more real estate and halt building on plants in Germany and Poland.

A partnership to produce a customized networking chip for Amazon. Com’s AWS was also announced by Intel. Both company’s meetings were covered by a news source earlier on Friday.

People also Reading

How the Fed’s Plans are Boosting the Dollar and Stocks?

Texas prepares for extra summertime power outages

Asia shares jump on Fed cuts bets; yen pares gains.

Why the Bank of Japan (BOJ) cancels radical policies.