How the Fed’s Plans are Boosting the Dollar and Stocks?

The Fed’s latest moves are fueling the dollar and stocks & propelling the S&P 500 to new highs. Discover how the Fed’s plans are impacting the markets and your investments.

After the US Federal Reserve started its easing cycle with a sizable rate cut and moderated it with a balanced outlook in an effort to keep the economy growing, the currency rebounded, long-dated bond yields increased, and Asian markets mainly gained.

Table of Contents

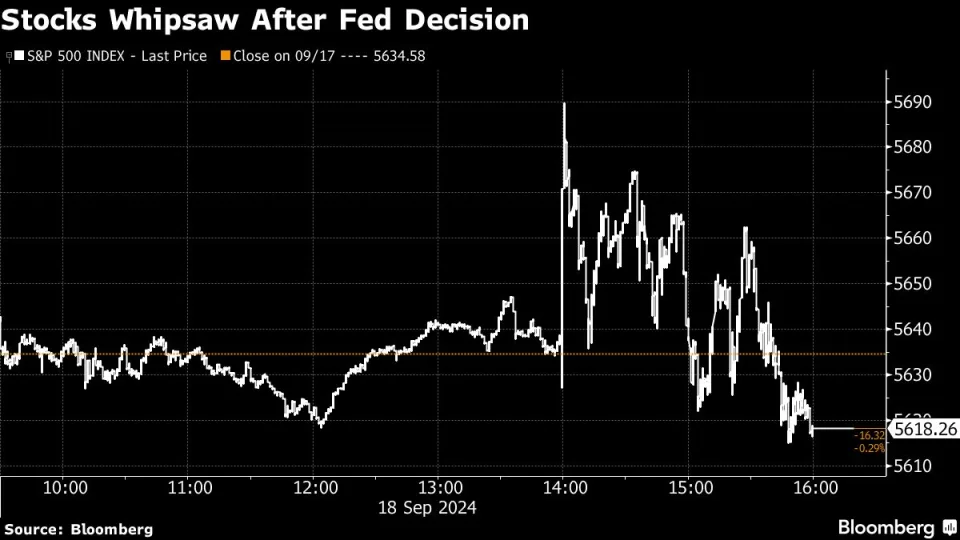

Overnight, the S&P 500 reached a new high before finishing little lower. On the Asia day, futures increased 0.6%, while Nasdaq futures saw a 0.9% increase. Australia’s stock market’s business reached a record high, while Japan’s Nikkei gained 2%. [.T][.AXE]

Markets had been trending towards 4.75–5% when the Fed narrowed the range for the standard rate of interest by fifty basis points prior to the announcement. The dollar quickly fell against the sterling to a two-and-a-half-year low before rising swiftly again. [FRX/] Early on Thursday, it was up about 1% to 143.55 yen, well above the euro’s lows of $1.1081.

The yield on ten-year Treasury notes increased by over eight basis points to 3.719% from the previous day, while the price of gold reached a record high of just under $2,600 an ounce before levelling off at $2,559. [GOL/] [US/] The US economy and consumption are anticipated to benefit from the Fed’s reduction.

“The way forward is what matters, and I believe they have presented a scenario where the market is still doing rather well,” BNZ analyst Jason Wong stated in Wellington. “The crucial factor was never supposed to be around 25 or 50. “This was not a 50 (bp) cut made in panic.”

Powell’s Policy Shift: Fed Rate Cut Measures Impact Markets and Investments

In contrast to their July view, policymakers revised down their median rate projection; however, Jerome Powell, the chairman of the Federal Reserve, underlined that data-driven decisions will guide future actions.

Following the announcement of the disproportionate cut, Powell told reporters, “I don’t think anyone ought to glance at that and declare oh, this is an improved pace.”

Our goal is to gradually reduce policy to a level that is more neutral. And considering the state of the economy, we’re going at the speed we believe is right.

Following a negative note from Morgan Stanley, South Korean markets experienced significant declines in the chipmaking industry upon their return from holiday, causing MSCI’s broadest indicator of shares in the Asia-Pacific region outside of Japan to decline 0.4% in early trade.

Shares of Samsung dropped 2.6% while SK Hynix plunged 9.6%. The Chinese benchmark CSI300 lost 0.4%, while Hong Kong’s Hang Seng saw a modest increase. Standard Brent crude futures saw a 0.3% decline at $73.42 per barrel as oil prices dropped. [O/R]

Theoretically, lower US interest rates around the area give emerging nations leeway to lower their policy rates as well as spur growth.

Bank Indonesia made its move with a 25-basis point drop on Wednesday, many hours ahead of the Federal Reserve. Early on Thursday, Chinese bond yields decreased as investors braced themselves for more relaxation from Beijing to support the country’s increasingly flagging economy.

Rates at the Bank of England are expected to remain at 5% when it meets later on Thursday, particularly in light of inflation data that indicates services inflation increased in August. The Bank of Japan announces its policy on Friday; it is anticipated to remain unchanged but to schedule additional hikes, maybe as early as October.

People also Reading

Texas prepares for extra summertime power outages

Asia shares steady after solid China trade data, yen stable

Asia shares jump on Fed cuts bets; yen pares gains.