The Rise of Bitcoin: A Comprehensive Analysis and Present Situation

Since its launch in 2009, Bitcoin—the forerunner of cryptocurrencies—has captured the attention of the financial community. Bitcoin, which was developed under the pseudonym Satoshi Nakamoto, popularised the idea of decentralised digital currency, upending established banking institutions and presenting a fresh approach to transactions. BTC has seen notable highs and lows over the years as it has changed in response to market conditions, legislative changes, and technology breakthroughs. This article examines Bitcoin’s current state, going over its history, difficulties, successes, and wider effects on the world economy.

I. The Origins of Bitcoin:

Table of Contents

The Whitepaper and Satoshi Nakamoto, The inception of Bitcoin dates as far as October 31, 2008, while Nakamoto published the whitepaper “BTC: A System for Peer-to- The document described the proposed distributed ledger technology, or blockchain, for a decentralised currency.

B. Blockchain technology and mining: The blockchain, a publicly accessible ledger that guarantees security and transparency, records Bitcoin transactions. Strong computers are used by miners to solve intricate mathematical puzzles, approving transactions and appending fresh coins to the chain. This decentralised method guards against manipulation and fraud.

II. The Historical Performance of Bitcoin:

A. Volatility of Prices: The price history of BTC has been characterised by tremendous volatility. After starting at almost nothing, the price of Bitcoin fluctuated quickly, peaking at almost $64,000 in the month of April 2021. Institutional and individual investors have been drawn to the price surge, but it has also sparked questions about how long these valuations can last.

B. Market Trends: The price fluctuations of bitcoin are frequently examined in terms of markets that are bullish or bearish as well as market cycles. Investors looking to succeed in the cryptocurrency landscape must comprehend these cycles. These cycles are influenced by various factors, including macroeconomic trends, regulatory developments, and adoption.

III. Adoption by Institutions:

A. Business Capital: Big businesses have become more interested in the digital currency BTC as an investment vehicle in recent years. Businesses that view BTC as a hedge against inflation as well as an alternative retain of value, such as MicroStrategy and Tesla, have assigned a portion of their Treasury vaults to the cryptocurrency.

B. Wall Street Involvement: Conventional financial institutions have begun to provide services and products linked to BTC. Institutional investors can gain radiation to the cryptocurrency sector through mutual funds, contracts for futures, and other derivatives linked to the BTC cryptocurrency. The general acceptance of btc has been aided by its incorporation into the larger financial system.

IV. Regulatory Environment:

Changes in Regulations: Because BTC is decentralised, it presents difficulties for regulators trying to find a middle ground between protecting investors and promoting innovation. Various strategies have been implemented by different nations to control or outlaw cryptocurrency activity. Regulation changes have a big impact on how much Bitcoin costs and how many people use it.

B. Legal Tender Status: In 2021, El Salvador made national news when it became the first nation to accept Bitcoin as its official currency. Reactions to this move were divided; supporters praised the innovation, while detractors voiced worries about possible effects on the nation’s financial stability and economy.

V. Transformations in Technology:

A. Solutions for Scaling: There has been debate regarding the scalability of BTC due to issues with transaction fees and speed. Several approaches, like the Lightning Network, try to solve these problems by making it possible for transactions to happen off the main blockchain more quickly and affordably. The utility of BTC for regular transactions is greatly increased by these scaling solutions.

B. Environmental Issues: The energy usage of BTC mining has sparked environmental issues, especially with relation to the carbon footprint of Proof-of-Work (PoW) consensus processes. While some contend that the advantages of decentralised currency are outweighed by their negative effects on the environment, others highlight continuous initiatives to switch to more environmentally friendly options.

VI. Obstacles and Rebuttals:

A. Security Issues: Although blockchain technology offers strong security, there are still risks in the BTC ecosystem. Hacks, frauds, and weaknesses in wallets and exchanges have brought attention to how crucial cybersecurity is to the bitcoin industry.

B. Manipulation of the Market: Because the BTC market has comparatively less liquidity than traditional financial markets, it is prone to manipulation. Price manipulation, pump-and-dump tactics, and the sway of large owners (whales) can all have an effect on investor confidence and market stability.

VII. Bitcoin’s Future:

A. Advances in Technology: The goal of ongoing developments in blockchain technology is to increase scalability, security, and efficiency. One such development is the upgrading of the BTC protocol. The goal of initiatives such as taproot as well as Schnorr signatures is to improve privacy and make it possible for the BTC network to support more intricate smart contracts.

B. Adoption by Institutions: The future of Bitcoin will probably be shaped by institutional investors’ continued involvement and the incorporation of the cryptocurrency into established financial systems. Adoption could be sped up even more by regulatory certainty and the creation of financial products suited to institutional needs.

C. Impact on Society and Economy: In addition to being a speculation property, BTC has the ability to decentralise global value transfers and expand financial inclusion for unbanked populations. Bitcoin’s socioeconomic impact will be determined by how well it navigates obstacles and fits into the current financial infrastructure.

In summary, Bitcoin’s transformation from a little-known digital toy to a well-known asset has been exceedingly of amazing. Its current state is a reflection of an evolving system that is always changing in response to market, regulatory, and technological advancements. Bitcoin’s place in the larger financial landscape will be determined by continued innovation, legal frameworks, and the combined efforts of its worldwide community, as it confronts both opportunities and challenges.

The 2023 BTC rally falters during a sharp 7.5% decline towards US$40,000.

Amidst a wider cryptocurrency sell-off, BTC experienced a further bout of its infamous volatility, plunging sharply towards US$40,000. The biggest token fell as much as 7.5% to US$40,521 on Monday, December 11, but it later recovered some of its losses and was trading 4% lower at US$42,095 at 11:12 a.m. Singapore time.

Smaller tokens like Avalanche, XRP, Polkadot, and Ether also experienced a decline. A measure of the top 100 digital assets fell by roughly 4%, marking the biggest decline since November 22. This year, Bitcoin has surged due to anticipation that US regulators will permit the first Bitcoin exchange-traded funds, thereby expanding the pool of possible cryptocurrency investors. Predictions that the US Federal Reserve will lower interest rates in 2019 also contributed to the surge in virtual currency values.

“Market leverage had increased significantly,” stated Richard Galvin, a co-founder of Digital Asset Capital Administration located in Sydney. “Rather than any fundamental news catalyst, the current decline appears to be the result of a market deleveraging.”

This week’s US inflation information and the Fed’s last policy meeting of the year 2023 are also expected to test investors’ bold bets on rate cuts.

Cryptoverse: In 2023, BTC proves its sceptics wrong

In the event that 2022 was the year that “cracked bitcoin,” 2023 has been the year of healing from trauma. Fortunately, despite low trading volumes, weak cryptocurrency prices, and challenging economic conditions, Bitcoin has rebounded. After a summer slump, it even got a boost in October.

“The recovery has been good, but we’re just at the beginning of an entirely fresh cycle,” asserted Kevin Koh, managing partner and co-founder of the investment firm Spartan Company. In fact, 2023 has proven to be a remarkably successful year for bitcoin.

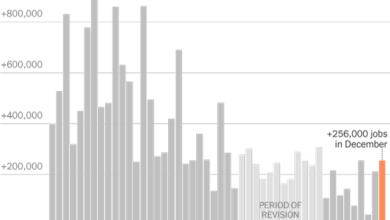

With a 164% increase since January 1st, the cryptocurrency market leader is now trading over $40,000. It has outperformed conventional assets, such as the S&P 500, which has gained 20%, and gold, which has increased by 10%.

According to CoinGecko data, Bitcoin boosted its market share from 38% to over 50% of all cryptocurrencies. After ether’s price spiked 95% higher, the total value of the cryptocurrency market jumped to $1.7 trillion at the peak of 2022 from $871 billion.

A large portion of bitcoin’s gains occurred later in the year when investor enthusiasm was rekindled by the prospect of an easier monetary policy and a possible the United States spot the digital currency bitcoin exchange-traded fund (ETF).

The overall spot along with derivatives volume of trade on centralised exchanges reached $3.61 trillion in the month of November, up from roughly the amount of $2.9 trillion in the month of January, indicating that trading volumes have also increased. This information is provided by CC Data.

Stablecoins, which are digital currencies with their value linked to a physical asset like the dollar, have also increased in value in the interim. With a market capitalization of over $90 billion, Tether is the largest coin of this type.

TITANS’ FALL

More cryptocurrency behemoths have failed in 2023 following a turbulent 2022 that saw the demise of FTX as well as Sam Bankman-Fried.

Changpeng Zhao, the CEO of Binance, entered a guilty plea to violating US anti-money laundering legislation as part of a multi-billion dollar settlement with authorities. Voyager Digital’s co-founder was also facing regulatory action from the United States, and in July, Alex Mashinsky, the founder of Celsius, was arrested and entered a not guilty plea to several criminal charges, including securities fraud.